North Africa has emerged as a strategic software engineering destination, with Egypt, Morocco, and Tunisia producing over 40,000 technology graduates annually and hosting a combined developer community of 350,000+ engineers.

Companies can hire senior software developers for $25,000-$55,000 annually compared to $140,000-$180,000 in the United States, achieving 70-80% cost savings while accessing educated, multilingual talent. Engineers in North Africa speak English, French, and Arabic, work in time zones that overlap 6-8 hours with European business days and 2-4 hours with U.S. East Coast operations, and possess strong mathematical foundations from rigorous educational systems.

The region combines favorable economics, political support for technology sectors, and growing entrepreneurial ecosystems. Countries invest heavily in digital infrastructure, technology parks, and startup incubators. Major companies including Microsoft, IBM, Orange, and Vodafone operate development centers across North Africa, creating experienced engineering talent pools that companies worldwide can access.

Why Is North Africa Becoming a Software Engineering Hub?

Several interconnected factors transformed North Africa into an attractive technology outsourcing destination:

Educational Excellence: North African countries emphasize mathematics and engineering education from primary school through university. Egypt graduates 15,000 computer science and engineering students annually from institutions like Cairo University, Ain Shams University, and American University in Cairo. Morocco produces 12,000 technology graduates from institutions including Al Akhawayn University and Mohammed V University. Tunisia contributes 8,000 engineers from École Polytechnique de Tunisie and other technical schools.

These educational systems produce engineers with strong theoretical foundations in algorithms, data structures, computer architecture, and mathematics. This depth enables engineers to tackle complex technical challenges and learn new technologies quickly.

Language Capabilities: North Africa’s colonial history and geographic position create unique linguistic advantages. Engineers typically speak three or more languages fluently. Arabic serves as the native language. French remains dominant in business and education, particularly in Morocco and Tunisia. English proficiency grows rapidly as engineers recognize its importance for international opportunities.

This multilingual capability benefits companies operating in multiple markets. A Moroccan developer can communicate with French clients, American stakeholders, and Middle Eastern users equally well.

Government Support: National governments identify technology as an economic priority. Egypt launched the Egypt Vision 2030 initiative, which dedicates resources to digital transformation and technology education. Morocco created Casablanca Technopark, Africa’s first technology park, and later established similar facilities in Rabat and Tangier. Tunisia implemented the Digital Tunisia 2020 strategy to grow the ICT sector.

These initiatives provide tax incentives, infrastructure investment, and regulatory support. They create environments where technology companies and startups can flourish.

Strategic Location: North Africa sits at the intersection of Europe, Africa, and the Middle East. Time zones facilitate collaboration with European companies during full business hours. U.S. East Coast businesses get 4-6 hours of overlap. Companies can structure work to provide extended coverage across multiple geographic markets.

Cost Advantages: North African countries offer significantly lower living costs than Western nations. This translates directly into lower salary requirements while engineers maintain excellent local purchasing power. A senior engineer earning $40,000 in Cairo enjoys a middle-class lifestyle with housing, healthcare, and education costs far below Western equivalents.

Which North African Countries Offer the Best Software Engineering Talent?

Three countries dominate North Africa’s technology landscape:

Egypt: Egypt hosts the largest developer community in North Africa with 180,000+ software engineers. Cairo serves as the primary technology hub with 100,000+ engineers, while Alexandria maintains a growing community of 35,000 developers. Smart Village, a technology park in Cairo, houses offices for Microsoft, IBM, Vodafone, Orange, and numerous startups.

Egyptian engineers excel in full-stack development, mobile applications, and enterprise software. They frequently work with Java, .NET, Python, JavaScript, and PHP. The country produces particularly strong backend developers and database specialists.

Egypt’s large population (105 million) creates domestic market demand that gives engineers practical experience building consumer applications, e-commerce platforms, and fintech solutions. Companies like Fawry, Paymob, and Vezeeta demonstrate Egypt’s growing technology ecosystem.

Salary ranges for Egyptian engineers:

- Junior developers: $12,000-$20,000 annually

- Mid-level developers: $20,000-$32,000 annually

- Senior developers: $30,000-$48,000 annually

- Technical leads: $45,000-$65,000 annually

Morocco: Morocco positions itself as a nearshore destination for European companies, particularly those in France and Spain. The country hosts 100,000+ software engineers concentrated in Casablanca, Rabat, and Marrakech. French companies establish development centers in Morocco due to shared language, similar time zones, and direct flights.

Moroccan engineers demonstrate strong proficiency in modern web development, mobile applications, and cloud technologies. They work extensively with React, Angular, Vue, Node.js, and AWS. The country produces excellent frontend developers and UX specialists.

Morocco’s stability, modern infrastructure, and business-friendly policies attract international investment. Companies like Ubisoft, Capgemini, and Accenture operate large development centers. This creates experienced engineers familiar with international work standards.

Salary ranges for Moroccan engineers:

- Junior developers: $15,000-$22,000 annually

- Mid-level developers: $22,000-$35,000 annually

- Senior developers: $32,000-$50,000 annually

- Technical leads: $48,000-$70,000 annually

Tunisia: Tunisia built a reputation for high-quality software development and strong engineering education. The country hosts 70,000+ developers, with concentration in Tunis, Sfax, and Sousse. Tunisia produces engineers with excellent theoretical foundations and problem-solving capabilities.

Tunisian engineers specialize in embedded systems, cybersecurity, and financial software. The country’s proximity to Europe and excellent French language skills make it attractive for European outsourcing. Tunisian engineers also demonstrate strong English capabilities, particularly among younger graduates.

Tunisia faces some political and economic challenges that create minor uncertainties. However, the technology sector remains resilient and continues growing. Companies like Sofrecom, Telnet, and ST Microelectronics maintain significant operations.

Salary ranges for Tunisian engineers:

- Junior developers: $14,000-$20,000 annually

- Mid-level developers: $20,000-$30,000 annually

- Senior developers: $28,000-$45,000 annually

- Technical leads: $42,000-$62,000 annually

What Technologies Do North African Software Engineers Use?

North African engineers work with modern technology stacks that match international standards:

Web Development:

- Frontend: React (most popular), Angular (common in enterprise), Vue.js (growing)

- Backend: Node.js, Python (Django, Flask), PHP (Laravel), Java (Spring Boot)

- Full-stack frameworks: Next.js, Nuxt.js gaining adoption

Mobile Development:

- Cross-platform: React Native and Flutter dominate

- Native iOS: Swift (though less common due to limited local iOS market)

- Native Android: Kotlin and Java (very strong due to Android market dominance)

Backend and APIs:

- Node.js with Express or Nest.js

- Python with Django or FastAPI

- Java with Spring ecosystem

- .NET Core for enterprise applications

- PHP with Laravel for web applications

Cloud and DevOps:

- AWS: Most common cloud platform

- Microsoft Azure: Strong in enterprise contexts

- Docker and Kubernetes: Standard for containerization

- Jenkins, GitLab CI/CD: Common automation tools

- Terraform: Growing for infrastructure as code

Databases:

- Relational: MySQL, PostgreSQL, SQL Server

- NoSQL: MongoDB, Redis, Elasticsearch

- Cloud databases: DynamoDB, Firebase

Specialized Technologies:

- Embedded systems: C, C++, Assembly (particularly strong in Tunisia)

- Cybersecurity: Penetration testing tools, security frameworks

- Data science: Python with Pandas, NumPy, scikit-learn

- Machine learning: TensorFlow, PyTorch (emerging)

Engineers stay current through online platforms like Coursera, Udemy, and Pluralsight. Local tech communities organize meetups, conferences, and hackathons. Events like Cairo ICT, Morocco Web Awards, and Tunisia Startup Act promote knowledge sharing and networking.

How Do Time Zones Affect Working With North African Engineers?

North Africa’s time zones create different advantages depending on client location:

For European Companies: North African time zones align perfectly with European business hours. Egypt operates on EET (UTC+2), providing exact alignment with Eastern European countries and just 1-2 hours ahead of Western Europe. Morocco uses WET/WEST (UTC+0/+1), matching UK and Irish time perfectly. Tunisia operates on CET (UTC+1), aligning with France, Germany, and Italy.

This synchronization enables real-time collaboration throughout entire business days. Teams can hold morning standups, afternoon planning sessions, and end-of-day reviews together. European companies treat North African teams as nearshore resources with minimal time zone friction.

For U.S. East Coast Companies: North Africa sits 5-7 hours ahead of U.S. Eastern Time. This creates 2-4 hours of overlap during typical work days. A company in New York (9 AM – 5 PM) overlaps with Cairo (4 PM – 10 PM local time) from 9 AM to 1 PM Eastern.

This partial overlap supports daily standups and quick synchronous communication while enabling extended coverage. North African engineers can begin work before U.S. teams arrive, make progress on tasks, and hand off completed work or questions during the overlap period.

For U.S. West Coast Companies: The 8-10 hour time difference creates minimal overlap. California companies (9 AM – 5 PM Pacific) overlap with Cairo (6 PM – 10 PM local time) for just 1-2 hours. This arrangement works best for asynchronous workflows where teams hand off work between time zones.

Some companies use this time difference advantageously. North African teams work during U.S. nighttime, making progress while American teams sleep. U.S. teams wake up to completed work, review it, and provide feedback for the next cycle. This creates near-continuous development cycles.

For Middle Eastern and African Companies: North African engineers work in the same or very similar time zones as clients in Gulf countries, East Africa, and West Africa. This makes North Africa ideal for companies serving African and Middle Eastern markets.

How Does English Proficiency Impact Working With North African Engineers?

Language capabilities represent both a strength and consideration when hiring North African talent:

French Dominance: Morocco and Tunisia use French extensively in business and education. Many engineers learned programming concepts in French and feel more comfortable in French technical discussions. Egypt uses Arabic and English more predominantly, with French less common.

For companies operating in French-speaking markets (France, Belgium, Switzerland, Quebec, West Africa), North African engineers provide perfect language fit. They can communicate with French clients, write documentation in French, and participate in French-language meetings.

English Proficiency Levels: English skills vary by country, age, and individual background:

Egypt: English proficiency is moderate to good, particularly among engineers in multinational companies. Private university graduates typically speak English well. Public university graduates show more variation. Engineers improve English quickly when working with international clients.

Morocco: English proficiency is growing but historically lower than French. Younger engineers (under 30) generally speak better English than older professionals. Engineers in international companies develop strong English skills. American and British companies in Morocco specifically hire for English capability.

Tunisia: English proficiency falls between Morocco and Egypt. Engineers read technical English well and can write clear documentation. Spoken English varies more widely. As with other countries, engineers working internationally develop strong verbal English skills.

Technical English: Engineers across North Africa read English technical documentation, follow English tutorials, and use English programming resources. They understand technical terminology and can discuss code, architecture, and algorithms in English. General conversation English sometimes lags behind technical English.

Practical Considerations:

- Written communication (email, Slack, documentation) typically works well

- Video calls may require patience initially as engineers build verbal confidence

- Accents exist but rarely prevent understanding after brief adjustment

- Engineers appreciate clients who speak clearly and avoid complex idioms

- Daily English use accelerates improvement rapidly

Companies can filter specifically for strong English speakers during hiring. Many North African engineers actively seek international opportunities and invest in English improvement. Agencies typically assess language skills during vetting and match engineers appropriately to client requirements.

What Are the Cost Benefits of Hiring North African Software Engineers?

North Africa offers compelling economics for companies managing development budgets:

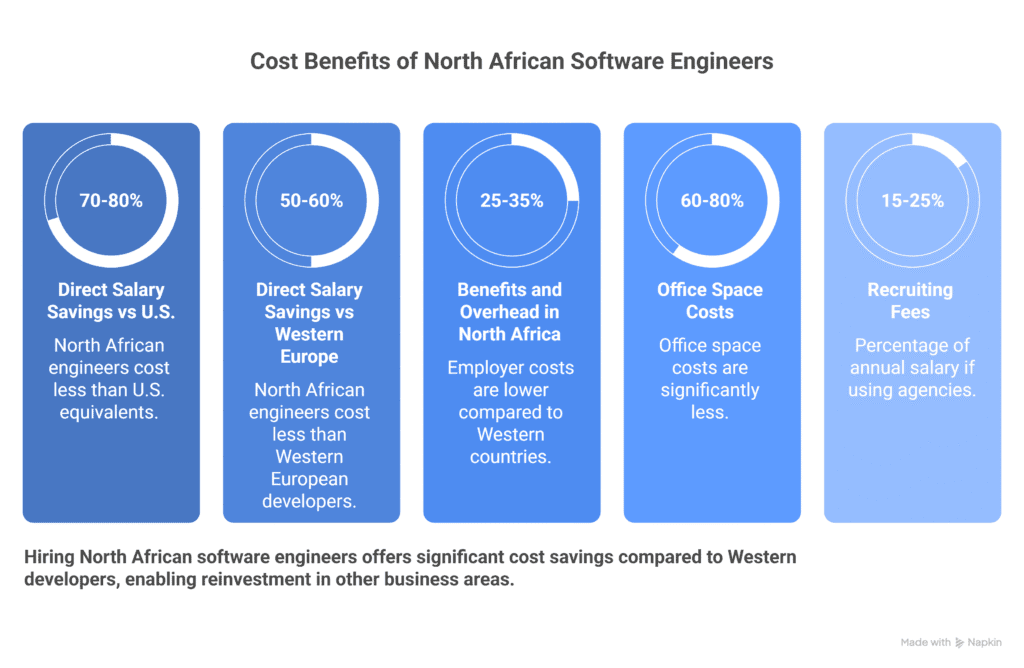

Direct Salary Savings: As outlined earlier, North African engineers cost 70-80% less than U.S. equivalents and 50-60% less than Western European developers. A senior full-stack developer costing $160,000 in San Francisco or $85,000 in Berlin costs $35,000-$45,000 in Cairo or Casablanca.

These savings scale linearly. A 10-person development team costing $1,200,000 annually in the U.S. costs approximately $300,000-$400,000 in North Africa. The $800,000+ savings can fund additional features, marketing, or business development.

Benefits and Overhead: Employer costs beyond salary are lower in North Africa. Social security contributions, health insurance, and other mandatory benefits typically add 25-35% to base salary compared to 40-50% in Western countries. Office space costs 60-80% less. Equipment and software licenses cost the same but represent smaller percentages of total compensation.

Currency Advantages: Companies paying in USD or EUR benefit from strong currencies against Egyptian pounds, Moroccan dirhams, and Tunisian dinars. Currency fluctuations can create additional savings, though responsible employers don’t exploit currency weakness to reduce real wages.

Quality-to-Cost Ratio: The key advantage isn’t just low cost but exceptional value. North African engineers provide quality work comparable to Western developers at fractions of the price. Companies get experienced senior engineers for mid-level Western prices.

Hidden Costs to Consider:

- Recruiting fees: 15-25% of annual salary if using agencies

- Equipment: Laptops, monitors, peripherals ($1,500-$2,500 per engineer)

- Management overhead: Remote teams require excellent project management

- Occasional travel: Annual in-person meetings improve team cohesion ($2,000-$4,000 per trip)

- Training and development: Courses, conferences, skill development ($500-$1,500 annually)

Even accounting for these additional costs, companies typically save 60-70% compared to domestic hiring while accessing skilled, dedicated professionals.

What Legal and Business Structures Work for Hiring in North Africa?

Companies can structure North African employment several ways:

Direct Employment: Companies establish legal entities in Egypt, Morocco, or Tunisia and employ engineers directly. This provides maximum control over employment terms, intellectual property, and operations. However, it requires significant setup:

- Company registration: $3,000-$8,000 depending on country and complexity

- Legal and accounting support: $1,500-$3,000 monthly

- Payroll setup: $2,000-$5,000 initial cost

- Ongoing compliance: Tax filings, labor law adherence, reporting requirements

Direct employment makes sense for companies hiring 10+ engineers or planning long-term operations in the region.

Independent Contractors: Companies engage engineers as contractors or freelancers. This offers flexibility and minimal administrative overhead. Contractors invoice for services and handle their own taxes and benefits.

Contractor relationships work well for project-based work or small teams. However, countries have rules about contractor classification. Long-term contractor relationships may be reclassified as employment, creating tax and legal liabilities.

Employer of Record (EOR): Third-party EOR services employ engineers on behalf of client companies. The EOR handles all local compliance, payroll, taxes, and benefits. Clients get employees without establishing local entities.

EORs typically charge 8-15% of gross salary plus setup fees ($500-$1,500 per employee). This model provides legal protection and administrative simplicity. It works excellently for companies testing markets or hiring small teams.

Staffing Agency Partnerships: Specialized agencies recruit, vet, employ, and manage engineers on behalf of clients. Unlike simple EORs, agencies provide end-to-end services including sourcing, technical assessment, ongoing management, and replacement guarantees.

Agencies typically charge markup on salaries (25-40%) or monthly fees per engineer. They assume all administrative burdens and often provide account management to ensure smooth operations.

Key Legal Considerations:

- Intellectual property: Ensure contracts clearly assign IP rights to the company

- Data protection: Egypt passed data protection law in 2020; Morocco and Tunisia have similar regulations

- Labor laws: Each country has specific requirements for employment contracts, termination, and benefits

- Tax treaties: Check for tax treaties between your country and North African nations to avoid double taxation

- Currency controls: Egypt has some currency restrictions; Morocco and Tunisia are more liberal

What Challenges Should Companies Expect When Hiring North African Engineers?

Being prepared for potential difficulties allows companies to mitigate risks:

Infrastructure Variability: Internet reliability varies by location. Major cities have good connectivity with fiber and 4G/5G networks. Power outages occur occasionally in Egypt. Companies should verify infrastructure during hiring and potentially provide backup internet solutions.

Economic Volatility: Egypt experiences currency fluctuations and inflation. Tunisia faces economic challenges. These factors create some uncertainty. Companies can mitigate this by paying in hard currency (USD/EUR) or providing regular salary reviews to maintain purchasing power.

Political Considerations: North African countries have varying levels of political stability. Tunisia experienced political changes in recent years. Egypt maintains strong central government but faces economic pressures. Morocco enjoys relative stability. Companies should monitor situations but recognize that technology sectors generally continue operating through political changes.

Cultural Differences: North African cultures differ from Western norms in communication styles, hierarchy, and business practices. Engineers may show more deference to authority or avoid direct confrontation. Companies should build inclusive cultures and clarify expectations about feedback and communication.

Religious Observances: Islam plays a central role in North African societies. Engineers may pray during work hours (5 minutes, multiple times daily). Ramadan requires fasting during daylight hours, which can affect energy levels and productivity. Friday serves as the holy day, though most companies work Friday-Saturday schedules to align with Western business weeks.

Successful companies respect religious practices while maintaining business operations. Flexibility and understanding build loyalty and appreciation.

Talent Competition: As North Africa gains recognition, competition for top engineers increases. Multinational companies, European outsourcers, and local startups compete for the same talent. Companies must move quickly through hiring and offer competitive packages.

How Do North African Engineers Compare to Other Offshore Regions?

Companies often evaluate multiple geographic options when considering offshore development:

North Africa vs. Eastern Europe: Eastern European engineers (Poland, Romania, Ukraine) typically cost more ($40,000-$75,000 for senior roles) than North African engineers ($30,000-$50,000). Eastern Europe offers excellent technical skills and strong English. North Africa provides better French language coverage and lower costs. Time zones favor Europe equally for both regions.

North Africa vs. Latin America: Latin America offers perfect time zone alignment with the United States. North Africa aligns better with Europe. Costs are similar, with Latin America slightly higher ($50,000-$85,000 for senior developers). English proficiency runs higher in Latin America. Both regions provide quality engineering talent.

North Africa vs. South Asia: India, Pakistan, and Bangladesh offer lower costs ($20,000-$40,000 for senior developers) and massive talent pools. However, time zone differences create collaboration challenges. English proficiency in South Asia is generally good. North Africa provides better European time zone alignment and French language capabilities.

North Africa vs. Southeast Asia: The Philippines offers excellent English and lower costs. Vietnam provides cost-effective development. Both regions face significant time zone challenges with Western clients. North Africa’s European and partial U.S. alignment provides collaboration advantages.

The best choice depends on specific requirements: target markets, language needs, time zone preferences, budget constraints, and technical specializations needed.

What Industries Hire North African Software Engineers Most Frequently?

Several industries particularly value North African engineering talent:

Banking and Financial Services: European and Middle Eastern banks hire North African engineers for core banking systems, payment platforms, fraud detection, and mobile banking. Engineers understand financial workflows and regulatory requirements. French banks particularly appreciate language alignment.

Telecommunications: Telecom companies including Orange, Vodafone, and local operators employ large engineering teams in North Africa. They build customer management systems, billing platforms, and network management tools.

E-Commerce and Retail: Companies building online shopping platforms, inventory systems, and logistics software hire North African developers. Engineers have experience serving both local markets and international clients.

Business Process Outsourcing (BPO): Large BPO companies including Teleperformance, Concentrix, and local providers operate centers in North Africa. They need engineers to build internal tools, customer service platforms, and automation systems.

Government and Public Sector: Digital transformation initiatives across North Africa create demand for engineers. Governments build citizen service platforms, tax systems, and administrative tools. International development organizations fund many projects.

Software Product Companies: SaaS companies, enterprise software vendors, and software consultancies hire North African engineers to build and maintain products. The cost savings allow companies to maintain larger development teams and move faster.

How Can Companies Successfully Manage North African Engineering Teams?

Effective management practices ensure successful outcomes:

Clear Communication: Establish communication protocols covering meeting schedules, response times, documentation standards, and escalation procedures. Use video calls for important discussions. Follow up verbal conversations with written summaries.

Cultural Sensitivity: Learn about North African cultures, business practices, and religious observances. Show respect for traditions and flexibility around religious practices. Build personal relationships through informal conversations.

Strong Onboarding: Provide comprehensive onboarding covering technical setup, codebase overview, development processes, and team introductions. Assign mentors or buddies. Set clear expectations for the first 30-60-90 days.

Regular Feedback: Provide frequent, specific feedback on work quality and performance. North African cultures sometimes avoid direct criticism, but engineers appreciate constructive feedback delivered respectfully. Focus on specific behaviors and outcomes rather than personal attributes.

Career Development: Offer learning opportunities, challenging projects, and clear advancement paths. Engineers stay with companies that invest in their growth. Provide training budgets, conference attendance, and mentorship.

Trust and Autonomy: Micromanagement destroys morale and productivity. Set clear goals, provide necessary resources, and trust engineers to deliver. Focus on outcomes rather than activity. Use metrics that matter: features shipped, bugs fixed, user satisfaction.

Team Integration: Include remote team members in all relevant meetings and discussions. Share context proactively. Celebrate wins together. Create virtual social events. Consider occasional in-person meetups if budget allows.

What Does the Future Hold for Software Engineering in North Africa?

Several trends suggest continued growth for North Africa’s technology sector:

Government Investment: Countries continue prioritizing technology sectors through infrastructure investment, educational programs, and business incentives. Egypt aims to triple technology exports by 2030. Morocco invests in technology parks and training programs. These commitments create favorable long-term conditions.

Ecosystem Maturation: Startup communities grow stronger with increasing venture capital investment, successful exits, and experienced entrepreneurs. This creates more sophisticated engineering talent with exposure to modern practices and technologies.

Infrastructure Improvement: Internet connectivity, data centers, and digital infrastructure continue improving. 5G rollout expands. Submarine cables increase international bandwidth. These improvements support higher-value technology work.

Demographic Advantages: North Africa has young, growing populations. Egypt’s median age is 24. Morocco’s is 29. These demographics create expanding talent pools as young people pursue technology careers.

Remote Work Normalization: Global acceptance of remote work permanently expands opportunities for North African engineers. Companies worldwide now consider distributed teams normal rather than exceptional, removing previous barriers.

Why North African Software Engineering Talent Creates Value for Global Companies

North Africa emerged as a strategic technology destination through educational investment, language capabilities, favorable economics, and geographic positioning between Europe and Africa. Engineers provide quality development work at costs far below Western markets while offering unique advantages like French proficiency and time zone alignment with European business hours.

Companies that successfully engage North African talent gain significant competitive advantages. They reduce development costs by 60-70%, access multilingual engineers who can serve multiple markets, and tap educated professionals with strong technical foundations. The key lies in understanding cultural contexts, managing remote teams effectively, and building partnerships that benefit both companies and engineers.

Whether companies need full-stack developers for web applications, mobile engineers for iOS and Android, backend specialists for APIs and microservices, or DevOps engineers for cloud infrastructure, North Africa provides qualified professionals ready to contribute immediately.

Scale Army connects businesses and startups with exceptional software engineering talent across Egypt, Morocco, and Nigeria. With pre-vetted engineers who understand international work standards, speak multiple languages, and deliver quality results, Scale Army handles recruiting, compliance, and administrative complexity while you focus on building products.

Companies access senior developers, specialized engineers, and complete development teams within weeks. For organizations looking to expand technical capacity while managing budgets effectively, Scale Army provides the talent, support, and expertise that drives success in competitive technology markets.

Access Skilled Engineers Across North Africa

Get support building a reliable hiring pipeline, comparing market rates, and sourcing vetted software talent from Morocco, Nigeria, Egypt, and More.

Talk to Our Team